The Risk of Using Home Equity to Pay Off Student Loans

/You had damn good timing!

You bought a house in late ’09 or ’10 after graduating college and getting a good job, maybe even starting a family. A few years later, with a rebound in both housing and the overall economy, your home is worth substantially more than what you owe on it.

Now, the conversation comes up: Should we use that equity to pay off our student loans?

Well, most likely, no.

There are 3 reasons why:

1. Understanding secured debt vs. unsecured debt

2. Losing benefits granted only to student loans

3. Insufficient savings

1. Understanding secured debt vs. unsecured debt

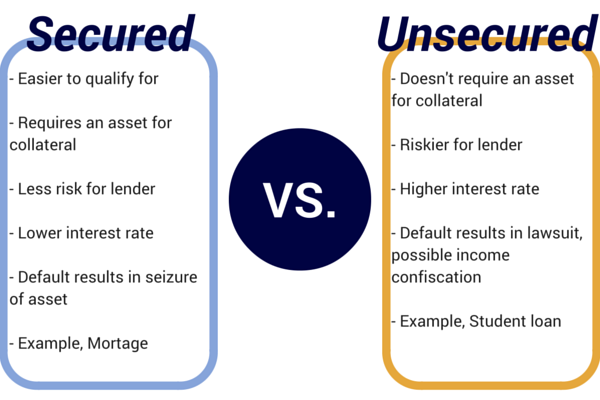

In short, secured debt is a loan backed up by something of value. The primary example of this is a mortgage. If you default on your mortgage, your debtor can claim the house or proceeds from the sale of the house to settle your account.

Unsecured debt, such as a student loan, is the opposite. It is not backed up by anything tangible. While defaulting still has consequences, the debtor can’t contractually claim your home as payment. Check the graphic:

2. Student Loan Specific Benefits

It will almost always be a bad idea to roll federal student loans into your home equity. Partly because they generally tend to have reasonable interest rates to begin with so you don’t gain much, but more importantly, you’ll lose access to all of the special features of the federal loans. You’ll no longer have the possibility of loan forgiveness, the ability to switch repayment plans, or to request forbearance during times of hardship.

The one area where using home equity might be potentially tempting is with private student loans; they are more likely to have higher or even adjustable interest rates. However, here’s the rub, more and more private lenders are starting to offer similar, though not as good, benefits as federal loans, for example, being able to defer payments if you lose your job.

Even if your lender hasn’t caught up to the times and isn’t offering nice perks, it still probably isn’t worth it to tap into your home. Why:

3. Insufficient Savings

It might not actually save you much money! A $40,000 private student loan with 7% interest and a term of 10 years is pretty much the same total cost as adding it to a 20yr mortgage with a 3.5% rate. It results in only roughly a $100 savings. That’s on top of ignoring origination and closing costs of a new loan.

To sum up: except in the rarest of circumstances, you should avoid comingling your home equity and your student loans. It’s just very unlikely for there to be enough savings to make up for the fact that you’re transforming an unsecured debt to a debt secured by your home and possibly losing flexibility offered by student loan providers.

Instead, look for some alternates to lessen your loan burden. I cover many in Every way to pay off your student loans, including using federal repayment plans and refinancing the loans themselves.